Payroll accountant

Payroll accountant

Dreaming of precise payroll and compensation management?

On this page, you will find comprehensive information about the payroll accountant profession: what the role involves, what accounting knowledge and precision skills are required, and how to determine if you are suited for the world of payroll calculation, compensation management, and employee accounting. Career guidance is done online here on the website, start now!

A payroll accountant specializes in salaries, wages, income tax reports, contributions to funds and insurance, responsibility for severance pay and pensions, and updating employment conditions and salary deductions in accordance with changes in the law and decisions of the Institute of Certified Public Accountants. Today, all payroll accounting work is performed digitally, based on advanced and dedicated payroll and accounting software that can be learned at Synel Oxbridge, which offers a focused and practical payroll accountant course.

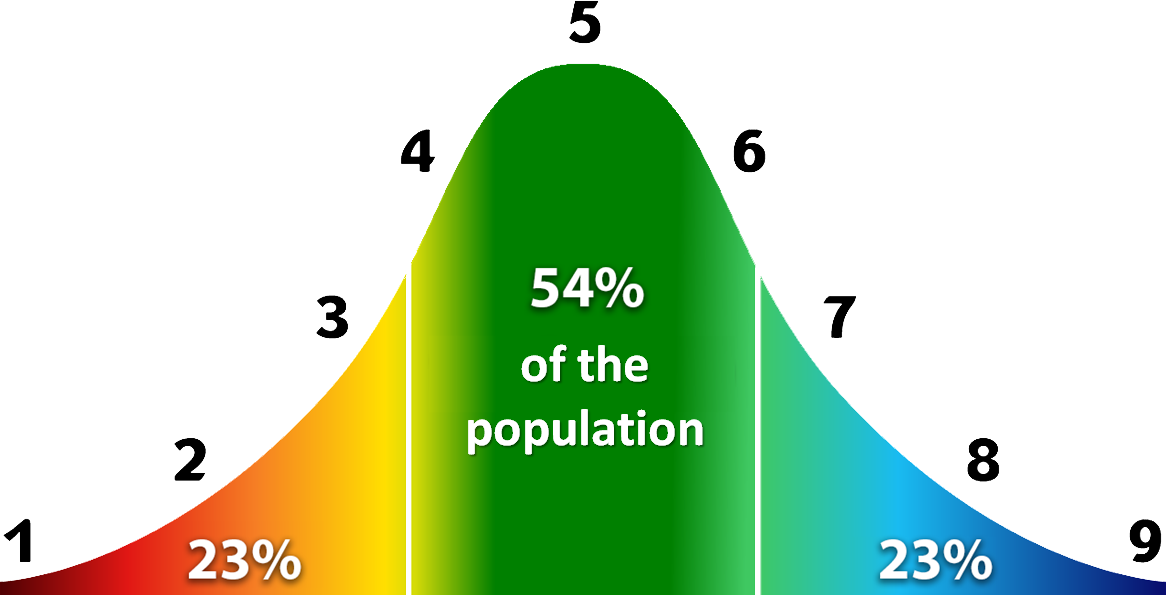

The [9] Scale: Represents the percentile of population that will reach or surpass this grade.

This implies the majority of the population will score 4, 5 or 6 and only a fraction will score 9 or 1.

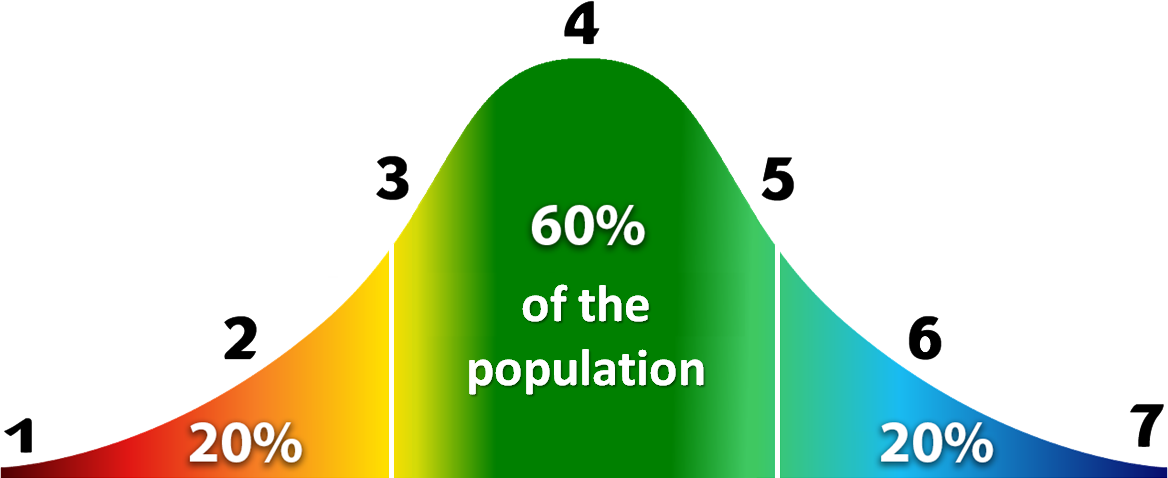

The [7] Scale: Represents the percentile of population that will reach or surpass this grade.

This implies the majority of the population will score 3, 4 or 5 and only a fraction will score 7 or 1.

The Personality Report is based on research conducted by Logipass that observed how a person ranks himself, his views and the way others rate him.

The scores range from "very high" to "very low" and are statistically relative, i.e. "very high" is relatively high in comparison to the population and in other words reflects the fact that the majority of people rank lower in a specific metric.

Tests and Characteristics

Candidates being tested for this position may be required to take the following tests:

Data Interpretation 8

Memory Test - Chores 5

Number Sequences 6

Memory Test - Numbers 10

Verbal Analogies 4

Mental Arithmetics 5

Verbal Reasoning 6

Shapes Matching 4

Sequence Matching 4

Information and additional options: